Safeguard

Deposit of Margin

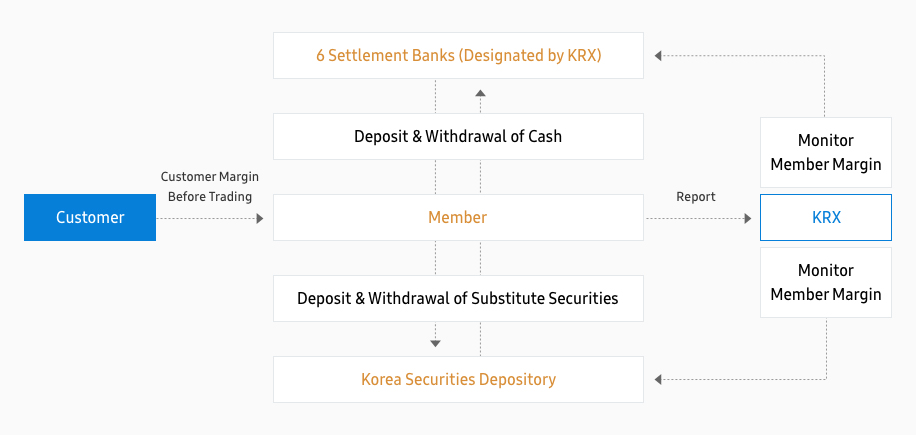

Customers, with the exception of qualified institutional investors, must deposit the customer margin with the member firms before placing an order. A member firm cannot submit the customers’ order unless the required margins are deposited. However, no margin deposit is necessary prior to trading for transactions between member firms and the KRX. In accordance with the rules and regulations of the KRX, member firms may deposit the member margins by noon of T+1 day.

Separate Accounting of

Customers’ Deposits

The regulations of the KRX are designed to protect customers from cases of insolvency or financial instability among member firms. A customer‘s deposit for futures trading must be maintained on a separate account apart from the properties of member firms. To protect customers, the Futures Trading Act requires that member firms deposit customer margins with the Korea Securities Finance Corporation (KSFC) and customers’ securities (substitute securities) with the Korea Securities Depository (KSD).

Monitoring of Financial Status

The KRX monitors the balance of margins of all members daily and checks their financial requirements. It also requires all

members to submit financial statements quarterly.

Joint Compensation Fund

-

Member firms of the KRX are required to contribute to the Joint Compensation Fund, which accumulates up to KRW 100 billion.

-

When a member firm fails to fulfill its obligations arising from futures trading, the KRX compensates for the resulting losses in

accordance with the following sequential procedures: -

In cases where a clearing member fails to fulfill its obligations following transactions in the futures market, the KRX compensates for the losses resulting from such failure by using

-

- the funds that the concerned clearing member contributed to the Joint Compensation Fund, together with the fidelity

guarantee money and the margins that the concerned clearing members deposited with the KRX and any cash due to the

concerned clearing member. -

- the Joint Compensation Funds of the market where the settlement failure occurred, which are contributed by other

clearing members. In this case, the amount borne by other clearing members is proportional to the amount that each member

contributed to the sum. - - the KRX’s own assets, including the settlement reserve that it has accumulated.

-

- the funds that the concerned clearing member contributed to the Joint Compensation Fund, together with the fidelity

Bank Credit Line

In addition to the Joint Compensation Fund, the KRX maintains a credit line of up to KRW 100 billion from a bank for any

emergencies that may occur on the KRX market.